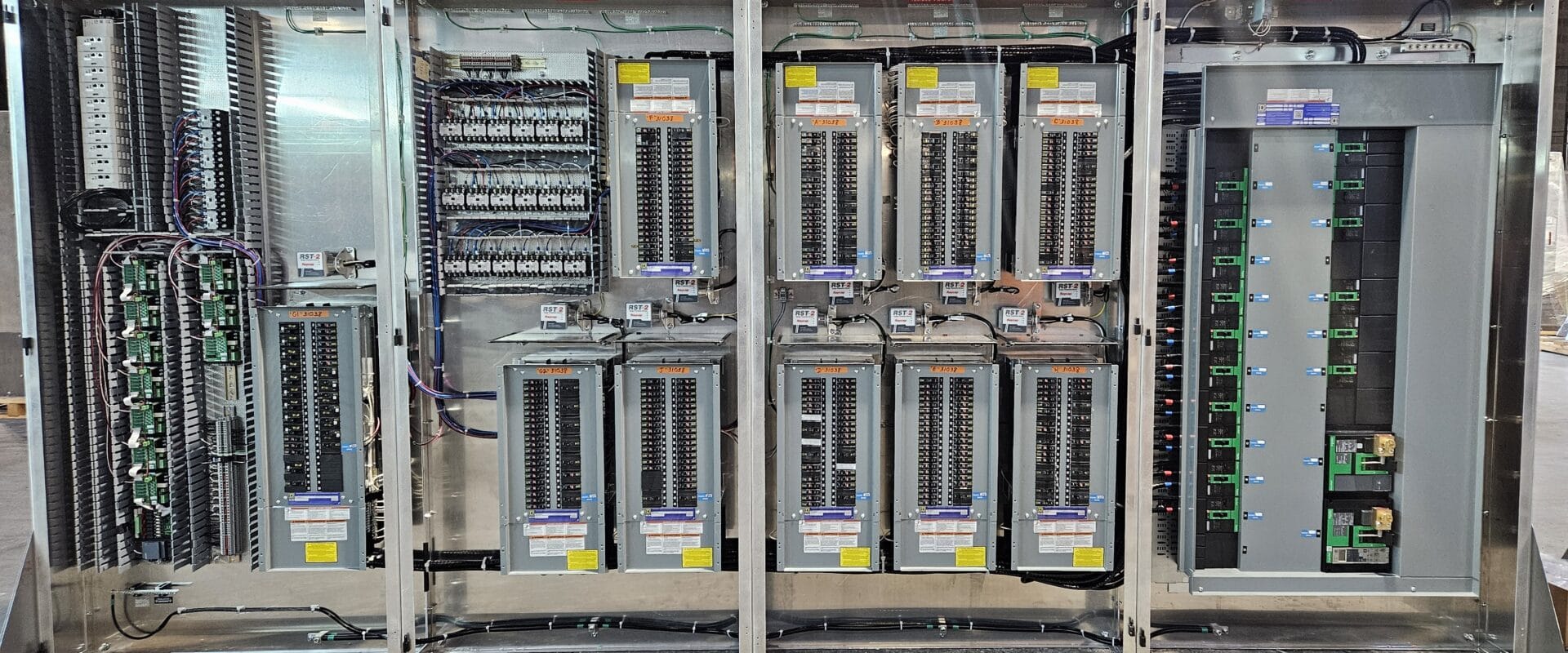

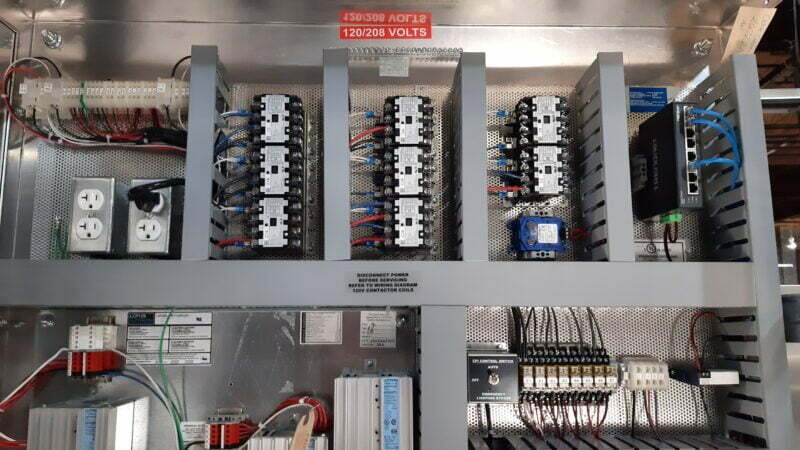

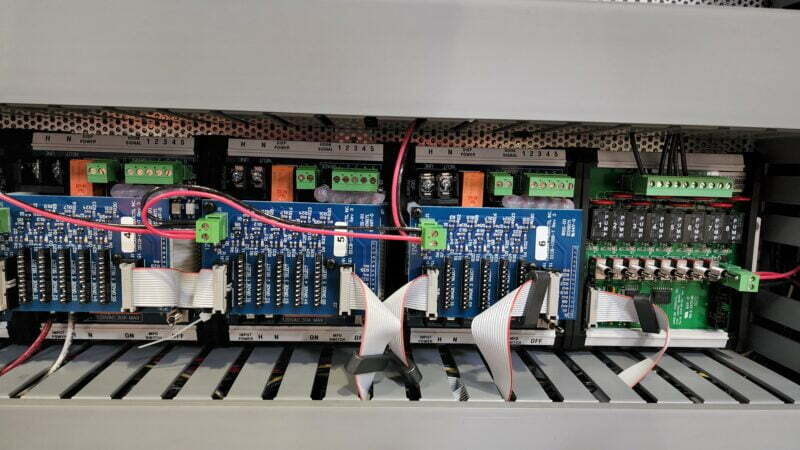

In our opinion, the control panels you are installing that include a microprocessor are considered “qualified technological equipment” as defined in Internal Revenue Code Section 168(i)(2). Therefore, these panels should be depreciated using the Modified Accelerated Cost Recovery System (MACRS) method over a life of five years.

Those panels that do not include a microprocessor are also eligible for depreciation over a life of five years. A recent Tax Court ruling determined that part of the cost of primary and secondary electrical systems that carry the electrical load to a company’s equipment is Section 1245 personal property and not structural components. Therefore, these assets are eligible for a shorter life.

Robert W. Elliot, Jr., C.P.A.

Elliot & Warren | Certified Public Accountants